2018-08-21

Recently, Jia Ming Zhu, the well-known economist in China wrote the Preface for “Blockchain Core Technology and Its Application” — Blockchain Technology and Its Applications at a Crossroad. Jia Ming Zhu authorized Seele to undertake the English translation of this preface and to publish the work to the western world for the first time.

Jia Ming Zhu Profile:

Jia Ming Zhu, economist, received his Master and PhD degrees in Economics from Chinese Academy of Social Sciences (CASS) in the 1980s and MBA from MIT.

In 1995, Dr. Zhu served for the Institute of Industrial Economy, CASS, Development Research Center of the State Council, China International Trust Corporation (CITIC), the Western Research Center of China, the Beijing Youth Economics Association, and the China Reform and Open Foundation with Mr. George Soros.

In 1984, Dr. Zhu was the initiator and main organizer of the Moganshan Conference, which is still influential today. Due to Dr. Zhu’s contribution to China’s early stage of reform in the 1980s, he was praised as one of “the four gentlemen”, the symbol of China’s reform history, with Jiangnan Huang, Yongxi Weng, and Qishan Wang.

In the 1990s, Dr. Zhu was a visiting scholar and a senior research fellow at Harvard University, Massachusetts Institute of Technology, and other world-renowned universities. After 2000, Dr. Zhu served for the United Nations Industrial Development Organization (UNIDO) as an economist and taught at the University of Vienna and the National University of Taiwan. Since 2010, Dr. Zhu has been following the progress of encrypted digital currency and blockchain and has conducted in-depth research. He is currently an academic adviser at the Beijing-based Digital Assets Research Institute of China. Dr. Zhu’s representative work is “From Laissez-faire to Monopoly: Monetary Economy of China, Past and Present”.

Jia Ming Zhu has authorized Seele to publish the following English translation of the preface for the first time. This gesture reflects Professor Jia Ming Zhu’s recognition of Seele’s dedication in the blockchain industry. Dr. Wei Bi and professor Jia Ming Zhu have conducted countless academic discussions and maintained a close relationship in the research area. We also hope to undertake more in-depth cooperation with Professor Jia Ming Zhu in the near future.

Jiaming Zhu: Blockchain Technology and Its Applications at a Crossroad — The Preface for “Blockchain Core Technology and Its Application”

Blockchain and its associated digital cryptocurrencies are undoubtedly new technologies that have emerged in the 21st century. In the past few years, especially since 2017, blockchain technology and its applications have attracted the attention, participation and application of scientists, thinkers, economists, entrepreneurs, and governmental, social and economic organizations around the world, thoroughly affecting the existing economic structure and economic behavior. On the one hand, it has rapidly formed a global “blockchain movement”; on the other hand, it has fallen into a “crossroads” because of the inherent defects and real world dilemmas of blockchain technology. Now, it is time to understand and learn about the real situation of blockchain and cryptocurrency rationally, break through the bottleneck of innovation in blockchain, and realize the evolution of blockchain technology. It is in this historical expectation that Zou Jun and three other authors wrote “Blockchain Core Technology and Application”, starting with the analysis of the core technology of the blockchain to comb through the technicalities of the blockchain and touch on the deep structure and scientific foundation of the blockchain, which I give my approval. The “Blockchain Core Technology and Application” consists of 12 chapters, more than 400 pages, and 260,000 characters. As a preface to a limited space, it focuses on the four basic issues facing the blockchain and its technical system at the “crossroads”:

1.

How to understand and learn about the “congenital effects” in the blockchain and the scientific aspects behind blockchain technology. In general, any new technology may have “gene” and “chromosome” problems, and the blockchain is no exception, which is likely to be reflected in the following four “limitations”:

1.1 Limitations of mathematical tools. It is generally believed that the core technology of the blockchain is cryptography, and one of the key points of cryptography in blockchain is the hash function. That is, the hash function is one of the cornerstones of the blockchain. There are many types of hash functions. Most hash functions are iterative, using a hash function and performing multiple iterations with different parameters. The problem is that the hash function, as well as the prime number closely related to each hash function, and even modern cryptography, all ultimately stem from “number theory”, of one of the branches in pure mathematics. Gauss said: “Mathematics is the queen of science, and number theory is the queen of mathematics.” Because number theory is still developing, the concept of hash functions are still young, so that there are problems such as the improper selection of algorithms that may cause more collisions and result in performance degradation and the limited transplantation of hash functions. Hence, the underlying technology of the blockchain chain is based on a “geological plate” that is still in its infancy. As for the internal relationship between a Merkle tree and the “hash function”, it is also a mathematical problem with the essence of the Byzantine’s General problem. In this sense, we can try to describe the blockchain in a mathematical language as a kind of “composite function” constructed by hash functions and based on number theory.

1.2 The limitations of “game theory”. The essence of the blockchain is a consensus system that involves multiple parties, forming a balanced relationship. This is also the key to the value of blockchain, especially public chains. The consensus system can be understood as a kind of “equilibrium” between nodes, and the “Nash equilibrium” based on the “game theory” is the closest to the state reflecting the blockchain consensus system. Specifically, the “Nash Equilibrium” refers to a combination of strategies: in a non-cooperative game, regardless of the choice of the other party, any player can only obtain the best benefit if only a certain deterministic strategy is selected. If any player separately chooses to change its strategy, it will damage its own income by leaving the “Nash equilibrium”. The problem is that Neumann and Nash’s research in the small-scale game under the finite “node” is insufficient to face the “complex behaviors of society and economy composed of huge objects of billions of nodes” [1]. A recent finding by a Ph.D. candidate at MIT pointed out that “it is almost impossible to find a Nash equilibrium point” [2]. The practical relationship between blockchain and “game theory”, including “Nash Equilibrium” is that on the one hand, blockchain needs “game theory”, including the support of “Nash Equilibrium” tools, but on the other hand, blockchain nodes’ arithmetic–even geometric–progression and growth model has broken through the framework and system of “game theory”. In short, because the nodes of the blockchain can infinitely expand, the “game theory” and “Nash equilibrium” that support the blockchain are bound to be stretched. As to the solution, the final scientific path has not been found so far.

1.3 Limitations of computer language and code. The blockchain is implemented by computer language and code. Without the injection of software, there is no life and operation of the blockchain. However, there is no perfect software. Firstly, blockchain programming languages are diversified, and it is difficult to find a blockchain programming language that has an absolute advantage; it can only be improved by the complementarity of different programming languages. In reality, it is very likely that any kind of programming language is not enough, and the lack of different programming languages causes the original blockchain to hurt its source. Secondly, at this stage, blockchain programming languages mainly rely on several “high-level languages” such as C++, Java, and Go. However, these languages need to evolve in order to meet the requirements of blockchain technology implementation. What is certain is that the existing “high-level languages” still have a lot of room for improvement. Logically speaking, the entire computer language system will continue to develop, and a new generation of computer language will inevitably have an impact on the blockchain and promote its evolution. Thirdly, existing computer languages are facing the integration with other new technologies, which in turn affect the technical system of the blockchain. For example, the convergence of artificial intelligence technology and programming languages is likely to lead to changes in computer language systems. Lastly, there also may be both conscious and unconscious mistakes made by the programmer. This book provides a framework diagram of blockchain and software-related errors, defects, faults, and failures [3].

Furthermore, so far the main underlying technology supporting blockchain has been generated earlier than the blockchain; these technologies were recombined because of the blockchain concept. That is to say, the current blockchain technology, and its mathematical and scientific foundations, are still quite fragile and difficult to support long-term and large-scale applications in business, economy, and society. There are many historical cases that show the process of the development of modern science and technology starting from a technology based on the principle of limited science and that forms a complete discipline and scientific system. For example, when the Wright brothers built the aircraft, it was based on some preliminary scientific principles and techniques. But with the evolution and industrialization of the aircraft, it eventually impacted other fields in order to advance the overall design of the aircraft, including aeronautics, materials science, electronic science, and many other comprehensive science and technology systems in many disciplines such as engineering manufacturing.

Therefore, the technology of the blockchain at this stage is very similar to the experimental phase of the Wright brothers. To fully realize the concept of blockchain, just like the history of aircraft, it is not only necessary to achieve all-weather and all-round sky flight, but also to enter space and beyond, which requires a complete scientific and technical system for support. It can be argued that due to the combination required for blockchain technology, there will be an adjustment period that adapts to the extensive applications of blockchains or a period of further development, which may eventually evolve into a comprehensive scientific system.

2.

Are there real and potential threats to the blockchain? The blockchain faces numerous technical dilemmas such as “scalability”, “privacy protection”, “storage”, and more. However, the real and potential threats that really make up the blockchain system are likely to focus on:

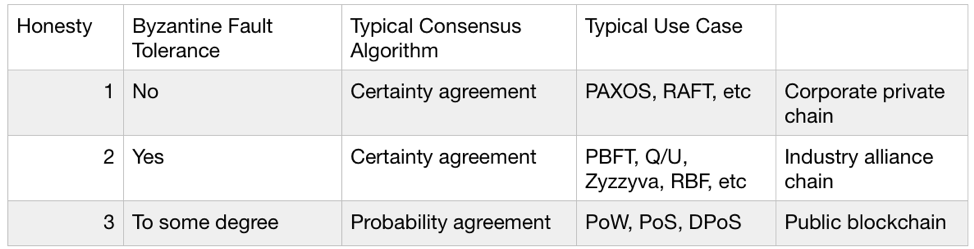

2.1 The possibility of a structural imbalance in the “consensus layer”. In the architecture of blockchains or in the distributed systems of blockchains, the “consensus layer” is crucial. The essence of consensus is an “algorithm”. A strict “consensus algorithm” needs to meet four conditions: termination, consistency, legitimacy, and honesty [4]. From a technical perspective, the blockchain consensus algorithm is based on asynchronous communication scenarios. In this way, the FLP theorem is involved. The theorem covers a series of characteristics such as no clock, no time synchronization, no timeout, no detection failure, arbitrary delay of messages, and disordered messages. In an asynchronous communication scenario, even if only one process fails, there is no algorithm to ensure that the non-failed processes will reach consistency [5]. Under such circumstances, the usual consensus algorithm tends to choose “security” and sacrifice “activity”, so that it is difficult to ensure consensus in a limited time [6]. That is to say, the consensus algorithms of various blockchains now have only relative meaning, and there is no unified consensus algorithm. Different types of blockchains have to adopt different types of consensus algorithms according to different requirements [7].

Not long ago, an author with the pseudonym as maxdeath proposed: in the third-generation blockchain technological breakthroughs, one is “zero-knowledge verification technology”, and another possible breakthrough is the truly infinitely scalable consensus algorithm [8]. This view is quite noteworthy.

Also, the function of the blockchain depends on a decentralized ledger, while the decentralized ledger depends on the consistency and correctness of the ledger data on different nodes, which ultimately determines the algorithm for implementing state consensus in the distributed system. Because the blockchain algorithm restricts the “consistency”, it inevitably affects the deep foundation of the decentralized ledger and the function of the blockchain.

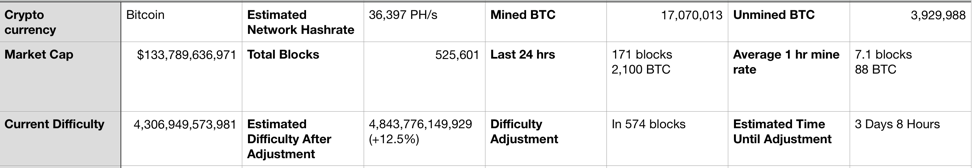

2.2 Monopolistic tendencies and trends of “computing power”. The operation mechanism of a blockchain can be understood as a process of continuously converting “single or multiple input values” into “single or multiple results”, so the blockchain is a kind of “calculation” [9], which naturally requires “computing power.” In particular, the “blockchain technology” represented by bitcoin uses the “proof of work mechanism (POW) [10]” to determine consensus on the ledger. This mechanism requires each node to perform a large number of complex function calculations, which enables the complete the consensus and increases the cost of the blockchain attack to improve the security. The introduction of this mechanism has had a profound impact on the development of blockchain technology: using only “computing power” to continuously mine out the block to achieve transaction accounting. If the blockchain does not have “computing power”, it will not be able to generate new blocks, and there will be cases where the transaction is not logged. This means the “death” of the blockchain. The role of “computing power” has also begun to be narrowly defined as “mining”, and its metric is known as the “hash rate”, which is “calculating the speed of the hash function output” in units of hash/s. “Miners” have become an important group in the blockchain such as Bitcoin, and they are constantly demanding more rights in the management of Bitcoin. The problem is that there may be a monopoly of the natural “power” of the blockchain. Taking Bitcoin as an example, in the past ten years, the realization of its “computing power” has experienced the eras from CPU to GPU,to the short-term FGPA stage, finally entering the mining pool monopoly era supported by ASIC mining machines. The total computing power of the bitcoin network in units of P hash/s computing power (1P=1024T, 1T=1024G, 1G=1024M, 1M=1024k) has reached 37,000P [11].

Satoshi Nakamoto did not anticipate the “computing power” monopoly supported by capital and industrial capabilities, which has long been more than just a simple question of competition and the consumption of energy, manpower, capital. This problem is also no longer just the problem in which individuals are deprived from obtaining Bitcoin wealth through mining, but rather is the loss of control from the monopolization of “computing power”, which is likely to create destruction of the blockchain and cryptocurrency ecosystem. It is very likely that there are only two possibilities: in order to maintain the “computing power” monopoly, the cost will continue to increase, and when the cost is higher than the income, it will stop; or perhaps in order to maintain the “computing power” monopoly, “exhausting the common pool”, and ultimately dying out together . The former can be understood as a “soft landing” while the latter can be understood as a “hard landing”, and the more likely scenario that appears will take place is the latter. Whether it is a “soft landing” or a “hard landing”, we need to be vigilant, and we need to prevent it through the underlying innovation of technology.

It should be noted that at present, based on the shortcomings of the “Proof of Work (POW)”, several different alternatives have been tried, such as “Proof of Stake (POS)” and “Distributed Proof of Stake” ( DPOS)” [12]. In particular, Vitalik Buterin proposed a verification mechanism that can strengthen client-side verification by allowing the possibility that the joint miner groups will collectively transfer power to attack the old blockchain (spawn-camp) for self-interest. The “coordination problem” of evenly distributed individual users increases the difficulty of success of the above attacks [13]. However, the above schemes do not mean that the idea of Proof of Work (POW) is outdated, nor does it mean that “computing power” should be abandoned. How this evolves, how “POW” will develop, and whether “computing power” can play a more important role in the blockchain requires time to find out.

2.3 Erosion from traditional economic models and tools. In the face of the blockchain and the cryptocurrency it supports, there is a widespread optimistic view: the birth, spread and application of blockchain and cryptocurrency have strong vitality and will bring disruption to the current economic ecosystem. This “new species” will change the traditional financial and industrial order, similar to the impact of the northern “barbarians” on the “Roman Empire”. However, in reality the opposite side appears to be true. That is, the traditional economic models and tools will erode blockchain and the cryptocurrency ecosystem. Firstly, the main value of the encrypted digital currency, such as Bitcoin, are to be reflected by fiat currencies, such as the US dollar. The reason for this is mainly because there is no “market” in the real world self-circulating market based on bitcoin, or other cryptocurrencies. Secondly, the traditional “capital” invested with fiat currency has fully entered the blockchain and cryptocurrency domain, forming a “capital sovereignty.” Thirdly, institutional models such as commercial banks, investment banks, and exchanges are “grafting” and even “merging” with blockchains, cryptocurrencies, and tokens. Fourthly, there have been “transplantations” of blockchain and cryptocurrency technologies into existing traditional economic and monetary systems in order to strengthen those systems. Some countries have begun development of legal cryptocurrency.

We should pay special attention now to the “wealth effect” illusion in blockchain, which exaggerates the value transfer, pricing, and trading of digital assets based on blockchain technology. This misleads people to understand and judge the value of blockchain based on the principles of traditional commercialization. In short, it is too early to answer the question of how the traditional economic models and blockchain systems will interact with each other, or the consequences of “mixing” each other and whether it is possible to reconstruct the human trust system. However, one thing is worth worrying about: blockchain and its ideas and technologies were originally intended to solve the shortcomings of the traditional economic system. In the face of the full-scale invasion of traditional economic instruments, policies and institutions, the existing blockchain ecosystem is still in an early and fragile stage. It does not have a strong self-protection mechanism and faces the possibility of being remodeled by traditional economic models and tools.

3.

What is the path of innovation for blockchain at this stage? The momentum of the blockchain in the past, present and future is determined by its capability to innovate. Blockchain innovations are mainly of two types: innovations under the current blockchain mainstream architecture and innovations that inherently break through the mainstream framework.

3.1 Innovation based on mainstream architecture and that feature “path dependence” traits. The general view now is that Bitcoin is 1.0 of the blockchain and Ethereum is 2.0 of the blockchain. However, both the blockchains of bitcoin and Ethereum follow the mainstream framework of “public chains”. The “innovation” under the mainstream framework focuses on, firstly, breaking the “scalability” limit. This mainly includes Bitcoin’s expansion scheme through “bifurcation”, Ethereum’s own Plasma, State Channel, Raiden, Truebit, Sharding, Casper and other expansion schemes [14], in addition to sidechain technology (Rootstock, Polkadot, Cosmos), block expansion, off-chain calculation, partitioned consensus, fragmentation of “internal segmentation”, and other proposals in the experimental phase [15]. Secondly, improving “storage.” Some of the engineering examples are: Swarm (Ethereum’s P2P file sharing protocol), Storj (a “distributed storage”), and IPFS (a P2P hypermedia protocol) [16]. Thirdly, EOS represents the blockchain operating system. According to it, EOS is expected to expand to thousands of TPS on a single-chain, with the entire network in parallel capable of throughput in the millions of TPS. The main network has been launched in June 2018, and is a strong competitor of the future blockchain platform [17]. Fourthly, the development of blockchains with privacy and regulations. For example, Cardano is the world’s first research-led blockchain project developed from the philosophy of science. It is also the first blockchain project to use peer-reviewed technology to send and receive digital funds and support various decentralized centers, applications, and smart contracts [18]. Fifthly, improving the security of smart contracts. A technique called “formal verification” is gradually being applied to blockchain smart contract code checking. The principle is to use mathematical methods to prove its correctness or inaccuracy according to some formal norms or attributes [19]. Sixthly, satisfying the blockchain test requirements referring to the “ISO/IEC 25010 standard.” In this model, blockchain evaluation involves eight dimensions, which in turn extends 31 subdimensions [20].

3.2 Breaking the innovation of the mainstream architecture in blockchain. It must be noted that innovation under the mainstream structure of the blockchain is only of relative significance. For example, Bitcoin is theoretically reversible. In the top-level design phase, the consensus problem is not completely solved, but the problem is transformed. “On the one hand, the serial number of the blockchain is used as the virtual time, and on the other hand, the economic power of “mining” is used to promote the continuation of blockchain” [21]. In this sense, Nakamoto used the economic method to solve the distributed system consensus problem, which is indeed quite intelligent. Furthermore, the blockchain at this stage is difficult to upgrade. Once the blockchain is deployed and enters production mode, adding, modifying, and deleting functions is very difficult and costly [22]. Nowadays, the usual blockchain modification will cause soft or hard forks of the blockchain system, which will require a lot of time and energy as input, and bear potentially large economic consequences.

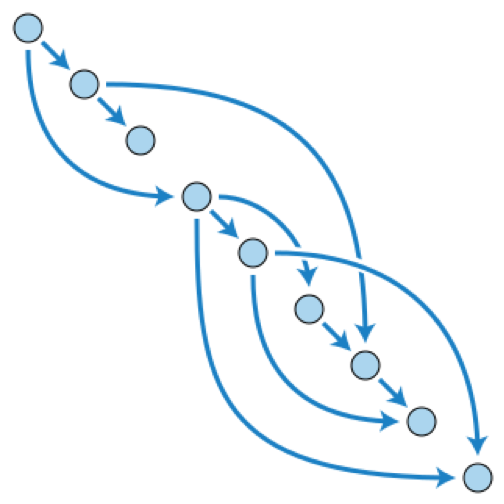

Therefore, the true innovation of the blockchain must break through the mainstream architecture and innovate in top-level theoretical design and mathematical methods. This breakthrough in the mainstream framework has quietly begun. So far, DAG (Directed Acyclic Graph), is an innovation that breaks through the mainstream architecture of the blockchain at this stage. “The efficiency of Bitcoin has been relatively low, partly due to the proof of work consensus algorithm. In addition, due to the chained storage structure, there can only be one chain at a time in the whole network, which leads to the inability to execute concurrently. A DAG fundamentally abandons the concept of blocks, so that transactions directly enter the whole network, achieving the so-called “Blockless” effect in which the network can accommodate N times more transactions. [23] Specifically, a DAG has four characteristics: “Firstly, the transaction speed is fast. The transaction speed is much faster than a blockchain’s transaction speed that is based on POW and POS. Secondly, there is no need to mine: a DAG directly devolves the transaction confirmation environment to the transaction itself, without the need for the miners to pack transactions into blocks and agree upon them. Therefore, there is no miner role in the DAG network. Thirdly, there is no handling fee: the transaction initiation requires only a simple proof of work, and the POW in the entire network is initiated by the originator, instead of being handed over to the miners. No transaction fees are required to initiate the transaction. Fourthly, a witness node is required: DAG needs the presence of a witness mechanism. This mechanism passes DPOS, POS, PBFT in a balance between efficiency and security” [24]. A DAG’s mathematical basis is no longer number theory, but features graph theory, topology, space and dimension transformations as subject of study. The principle of graph theory is clearly closer to the description of the basic pattern of blockchain. The DAG mode is as follows [25]:

4.

How do we achieve and maintain “entropy reduction” in the blockchain system? Blockchain is a typical information system whose vitality depends on its internal “information entropy”: large and small, high and low.

Zou Jun put forward in the preface of “Blockchain Core Technology and Application”: “In Shannon’s information theory, information is a certain amount, and entropy is also a measure of information. The larger the entropy, the more chaos, and the less information. In this sense, the blockchain system is a system that reduces entropy, because the state determined by the consensus is information, and the information is orderly and deterministic” [27]. Whether Zou Jun’s above statement is accurate may need to be discussed. However, Zou Jun proposed two meaningful problems: First, the blockchain is a system with reduced entropy; second, consensus leads to a decrease in entropy.

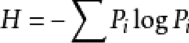

4.1 What is “information entropy”? In order to understand “information entropy”, we first need to understand what is “information”? There is no standard definition of “information”. According to the “information theory” by Shannon (C. E. Shannon, 1916–2001), information can be understood as a series of sequences encoded by the “01” in logic (ie, the “binary” of the computer). As for “information entropy”, it is based on an abstraction in mathematics or statistics. It describes a property of “information” itself, which is independent of the “formal content” of “information.” Specifically, there are several basic attributes of “information entropy”: (1) monotonicity. The higher the probability of occurrence, the lower the uncertainty, and the lower the information entropy it carries. Conversely, the more possibilities an event has, the greater the uncertainty. (2) Non-negative. That is, “information entropy” cannot be negative. (3) “Information entropy” should be continuously changing with probability. (4) Accumulation. That is, the measure of the total uncertainty of simultaneous occurrence of multiple random events can be expressed as the sum of the measures of uncertainty of each event [28]. Here, the concept of “information entropy” and “information volume” overlap. “Information volume” is a measure of the “uncertainty” of information elimination. More precisely, information entropy is “the average measure of the uncertainty of random variables” [29]. In other words, “information entropy” is a measure of the “uncertainty” of information. The greater the “uncertainty”, the larger the “information entropy”. “Information entropy” can also be understood as the average code length of a series of sequences encoding an event with “01”. The unit of code length is a “bit”. Therefore, “information entropy” is also a mathematical expectation.

4.2 Why is the blockchain formed in an orderly manner? Fundamentally speaking, the information system of the blockchain naturally has a structure that overcomes the “entropy increase” and realizes the “entropy reduction”. This is because the general information system is different from the material world, it has the following basic characteristics: (1) reproducibility, which makes it difficult to be unique; (2) disorderly diffusion; (3) ease to be distorted, evolved, lost; (4) not considering the information source playing the role of Maxwell’s demon in the flow of information, the information system is more prone to disorder due to the basic characteristics of information; (5) combined with the centralized information system, in principle it is just an shaky foundation that amplifies and reduces information, and is difficult to achieve the true order and certainty of the system. Therefore, the general information system is difficult to overcome the “entropy increase” attribute; it is difficult to achieve the true order and certainty of the system. Because the blockchain information system contains a “consensus mechanism” that contains holographic records of time, subject, content, and contains decentralized systems and node distributions, leads to “entropy reduction” and an increase in stability.

However, in real blockchain systems, “entropy reduction” of the blockchain does not occur naturally. That is to say, realizing the authenticity and integrity of data and information at any level in the blockchain architecture is not an easy task, especially the possibility of structural imbalances in the “consensus layer”. If you consider that the blockchain naturally needs “computing power” and requires the mining of blocks to achieve accounting, mining requires the use of increasing energy and human resources, blockchain and its associated encryption. Digital currency can’t get rid of the “entropy” theorem of thermodynamics. Therefore, in terms of blockchain technology and its increasingly widespread applications, how to achieve a continuous “entropy reduction” state is quite challenging.

4.3 “Dissipative Structure Theory” and blockchain [30]. In physics, the theory that best explains the blockchain is probably the “dissipative structure theory”: an open system far from equilibrium. In the process of exchanging matter and energy with the external environment, through the energy dissipation and the nonlinear dynamic internal mechanism, the energy reaches a certain degree in which the entropy flow may be negative and the total entropy change of the system can be less than zero, so that macroscopically the system may change from an originally disordered state to an ordered state in the dynamic of time, space, or function [31]. Looking at it now, the blockchain is likely to belong to the “dissipative structure”, which is a “self-organizing” system and has synergistic actions and coherent effects among various factors, and solves the mechanism that the information system moves from disorder to order. The “self-organizing” system of the blockchain adapts to the general environment and is more flexible and robust. In particular, the “self-organizing” “blockchain system” has the possibility of self-improvement, eliminating the decaying trend caused by the macroscopic “entropy increase”. Furthermore, blockchain, as a “self-organizing dissipative structure”, has the potential of self-will and self-creation, evolution, and self-development, rather than simply being influenced and shaped by external conditions. The blockchain, along with the operation of the computing power, will continue to form new ordered structures and generate new energy. From this perspective, the blockchain structure has endogenous evolutionary logic. Therefore, it is necessary to mention “Maxwell’s Demon” [32]. Maxwell once posed a thought experiment: a system that could “catch” the originally thermally balanced molecules from a closed box from one side to the other, allowing a thermodynamic system to automatically reduce entropy, thereby violating the “entropy increase” and “entropy maximization principle”. However, this thought experiment has been proven to be incapable of violating the “maximum principle of entropy.” Because the experiment found that the “little demon”, in order to find and distinguish the speed of molecular motion and eliminate their own information records, also needs to consume energy, resulting in an entropy increase. One of the implications of this thought experiment is that intelligence can be a “dissipative structure” scheme. In a sense, the blockchain system is a kind of “Maxwell’s demon”. That is to say, the blockchain itself is an intelligence.

It should be noted here that, so far, Bitcoin and other blockchain structures are in line with the “dissipative structure” model. Otherwise, Bitcoin could not have lasted for ten years. However, according to the initial design of Bitcoin, whether Bitcoin can always be in a “dissipative structure” for the next 100 years from now to 2140, maintaining “entropy reduction” and avoiding the “entropy increase” state, is too hard to simply judge due to the influence of endogenous and exogenous factors. Nonetheless, what is certain is that in the past four or fifty years, the traditional fiat currency has changed from “arithmetic” to “geometric” growth in the process of being a non-”dissipative structure” and “entropy increase”. This has resulted in the global monetary system to embark on the road of “entropy increase”.

Before ending this preface, I would like to inform the reader that “The core technology and application of blockchain” edited by Zou Jun, the previous book “Technical Guide to Blockchain”, and a large number of books on the blockchain in the market have the following noteworthy aspects: Firstly, the macro view. This book starts from the background of the limitations of the contemporary Internet and the evolution of computing models, then cuts into the concept and technical framework of the blockchain, and finally decomposes blockchain technology, so that readers can see the whole picture of blockchain technology and its applications. Secondly, systematization. This book decomposes, combs, and summarizes the problems related to blockchain technology, capturing the “least common multiple” of blockchain technology, and finally forms twelve themes, each subdivided into three levels. Such a framework design is beneficial for systematic discussion of blockchain technology. Thirdly, scientific description. In the process of explaining technology, this book goes beyond the visual examples of daily life, and uses mathematical language and symbolic language to describe, thus accurately conveying concepts and logic. Fourthly, transcending conceptualization. This book does not stop at the introduction of the concept, but provides a lot of discussion about the “implementation process”, “operation mechanism” and “interaction relationship” behind the concept, such as discussing the question “whether Bitcoin’s POW can solve the Byzantine general problem”, “accounting using POW”, and more. Fifthly, emphasizes the importance of and cites the dialogue of English documents. A large number of references to English publications have been made in this book, and to a certain extent, makes up for the shortcomings of the current publications on Chinese blockchain articles. Of course, due to the limitations of the division of labor, the book is rough and full of repetition, and there is still a certain distance from the refinement and conciseness. I hope this book has a chance to reprint and be perfected.

It is foreseeable that the development and growth of the blockchain will encounter “crossroads” one after another, creating challenges again and again. However, it is believed that the intrinsic learning ability of the blockchain will help it make the right choice at each “crossroad”. With the future development and growth of the blockchain, the real economy in human society is being surpassed by the conceptual economy, and the digital world, parallel to the physical world, is fully emerging. Blockchain will be an important bridge connecting the real economy with the conceptual economy and the digital world with the physical world. This is where the true historical function of the blockchain lies.

[1] Chapter 13.5“Evaluation of Reward Layer” of the book.

[2] As above.

[3] Figure 13–3“Schematic diagram of the mechanisms in software failure”in the book.

[4] Chapter 13.6 “Evaluation of the Consensus Layer” of the book.

[5] “FLP Impossibility”, https://blog.csdn.net/chen77716/article/details/27963079

[6] Chapter 5.1.2 “Basic Definitions of Consensus Systems”of the book.

[7] Diagram 13–4 “Classification of Consensus Algorithms”of the book.

[8] https://www.zhihu.com/question/265273597/answer/294404050。

[9] https://zh.wikipedia.org/wiki/%E8%AE%A1%E7%AE%97

[10] Chapter 5 “Consensus Algorithms”of the book.

[11] Reference image from http://mining.btcfans.com/.

[12] Chapter 5 “Consensus Algorithms”of the book.

[13] “Engineering Security Through Coordination Problems”,by Vitalik Buterin.

[14] Chapter 11.3.1 “Ethereum: Transformation of Blockchain Faucets”of the book.

[15] Chapter 11.2 “Typical Requirements and Development Directions of Blockchain”of the book.

[16] Chapter 11.3.10 “Storage in Blockchain”of the book.

[17] Chapter 11.3.2 “EOS: Blockchain’s Operating System”of the book.

[18] Chapter 11.3.3 “Cardano: Blockchain with Privacy and Regulations”of the book.

[19] https://zh.wikipedia.org/wiki/%E5%BD%A2%E5%BC%8F%E9%AA%8C%E8%AF%81.

[20] Chapter 13.2 “Evaluation Strategies”of the book.

[21] “The origin of blockchain — the origin and development of blockchain from a viewpoint of computer science”, https://blog.csdn.net/omnispace/article/details/80467188.

[22] “MOAC Claims to be the Mother of all Public Chains: What Innovations have They Made in Blockchain?”

[23] https://zhuanlan.zhihu.com/p/31764777.

[24] The same as [23]

[25] https://ethereum.stackexchange.com/questions/1993/what-actually-is-a-dag.

[26] https://www.jianshu.com/p/9f181cefba8d?from=timeline.

[27] Authors’Foreword.

[28] https://www.zhihu.com/question/22178202.

[29] In 1948, Shannon did not answer “what is information” in his dozens pages long paper “Mathematics of Communication”, but instead proposed the measurement of information, creating a famous mathematical expression formula for calculating “information entropy” H.

“Information entropy” is a mathematical expectation of the sum of the bit quantities of random variables and the probability of sequential occurrence.

[31] http://wiki.mbalib.com/zh-tw/%E8%80%97%E6%95%A3%E7%BB%93%E6%9E%84%E7%90%86%E8%AE%BA

[32] Maxwell’s demon, was a thought experiment proposed in 1871 by British physicist James Clerk Maxwell (1831–1879) to illustrate the possibility of violating the second law of thermodynamics.

Acknowledgement

Many thanks go to mathematicians Cui Wei and Qi Hongsheng, and computer experts Zhou Jun, Cheng Wenbin,Zhang Hongwei, especially Zheng Yanwei. They actively participated in the technical discussions and provided many helpful suggestions and comments while the writing of this article.